Oct 03 2025

/

Latin America Travel Agencies: What They Expect from B2B Providers in 2026 (Case Study)

Introduction

This case study was developed by B2B Travel Partner to provide operational evidence on what Latin America Travel Agencies require from their B2B providers for 2026: product access, relationship channels, response times, and local support needed to onboard and operate new suppliers with confidence. As highlighted in our article on travel representation companies, agencies in the region place high value on partners who combine technology with local presence to activate real distribution.

Between August and September 2025, we conducted semi-structured interviews and a short survey with 100 agencies in Brazil, Mexico, Colombia, Argentina, Chile, Peru, and Panama.

The sample was purposive: we selected referential contacts who work with us in the region—wholesale and retail travel agencies with decision authority and operational experience—to obtain an accurate picture of channel criteria and practices.

Objective

Identify—based on the day-to-day practice of sales and product teams in Latin America—what they need to activate sales with B2B providers (what works, what does not, and why), and prioritize operational solutions for 2026. This study focuses specifically on Latin America Travel Agencies and their decision dynamics with international suppliers.

Target Population

B2B trade professionals—Latin America Travel Agencies and wholesalers/consolidators, retail agencies, OTAs, MICE/PCO, Corporate TMC—across sales, product/contracting, operations, and leadership, who are starting or re-starting relationships with international providers (hotels, DMCs, attractions, cruise lines, car rental, airlines, destinations/DMOs). Results are reported in aggregate (no sub-segment splits in this publication).

Sample

n = 100 agencies/companies (analytical base: 100 = 100%).

Types included: wholesalers/consolidators, retail agencies, OTAs, MICE/PCO, Corporate TMC, and others (representations/clusters).

Balanced mix by size and focus, ensuring diverse operational scenarios among Latin America Travel Agencies.

Fieldwork

August–September 2025 (≈ 5 weeks of fieldwork).

Semi-structured interviews + short questionnaire administered in September 2025 to consolidate responses as percentages (base-100).

Data collection and cleaning by the B2B Travel Partner team.

Questionnaire Design (order applied)

1) How Latin America Travel Agencies receive new B2B travel product (primary channels)

2) How Latin America Travel Agencies Actually Get New B2B Products

3) Usage frequency of channels and tools among Latin America Travel Agencies

4) Operational problems that hinder information and bookings in Latin America Travel Agencies

5) Which Options Agencies Have to Resolve a Booking Request

6) Most common distribution issues in Latin America Travel Agencies.

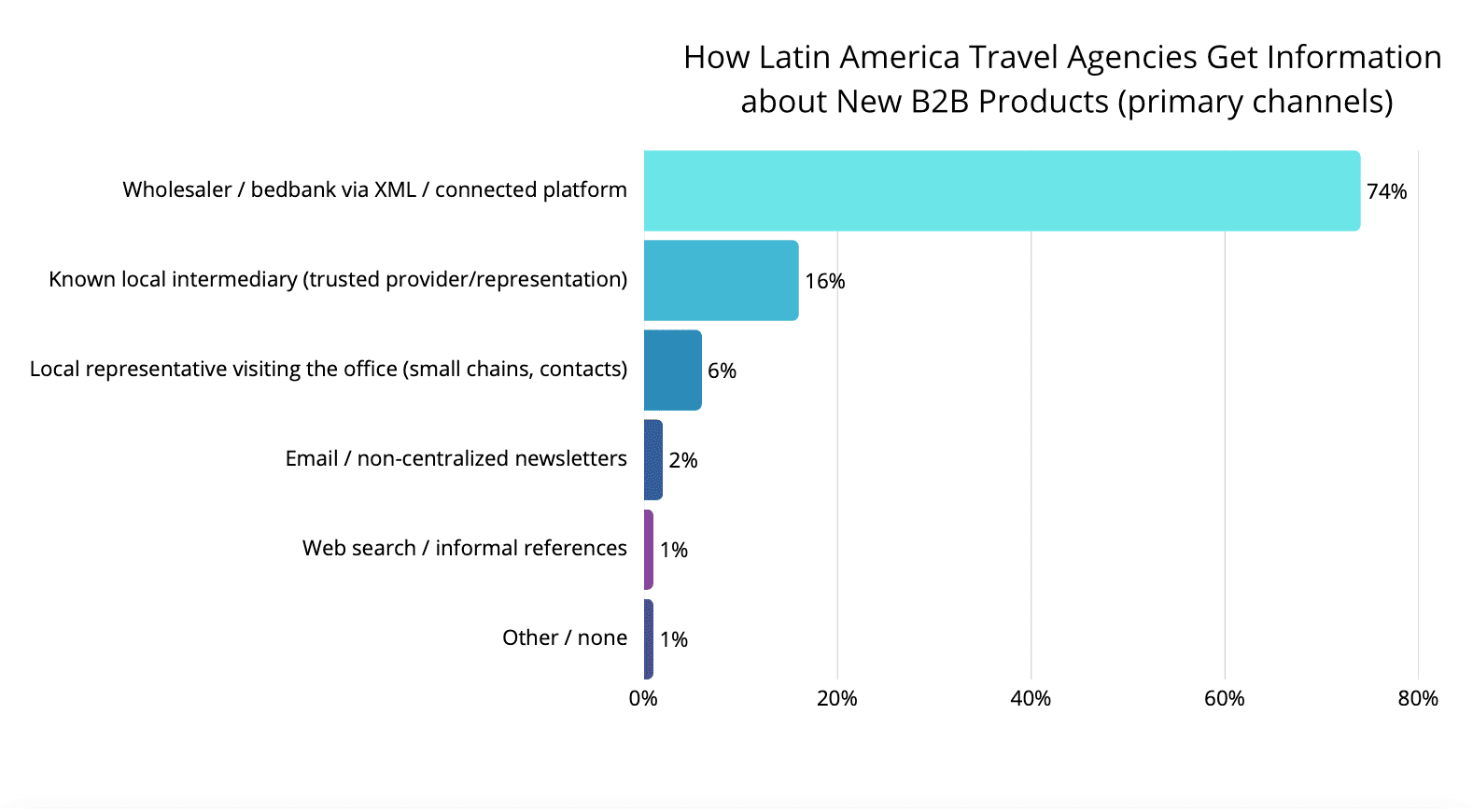

1) How Latin America Travel Agencies Get Information about New B2B Products (primary channels)

By B2B travel product we mean hotels, attractions/tickets, transfers and ground transportation, air content, and destination programs/itineraries. For Latin America Travel Agencies, this product arrives primarily through connected wholesaler/bedbank platforms (XML/extranet).

Local representations and 1:1 visits act as accelerators: they validate conditions, clear operational doubts, and turn a “listing” into an active commercial offer. Outside these channels, mass email and ad-hoc searches contribute very little usable volume.

- Wholesaler / bedbank via XML / connected platform: 74%

- Known local intermediary (trusted provider/representation): 16%

- Local representative visiting the office (small chains, contacts): 6%

- Email / non-centralized newsletters: 2%

- Web search / informal references: 1%

- Other / none: 1%

Reading: For Latin America travel agencies, the XML/extranet platform accounts for 74% of how new products enter the market, making it the dominant transactional channel. Alternative paths add very little: mass email, searches, or informal references together make up less than 5%. In this context, local representatives represent only 6%, but this is precisely where a major untapped opportunity lies.

When a local team visits an agency, explains the product, and resolves doubts, a simple contract uploaded to the platform becomes an active offer that the agency is willing to sell.

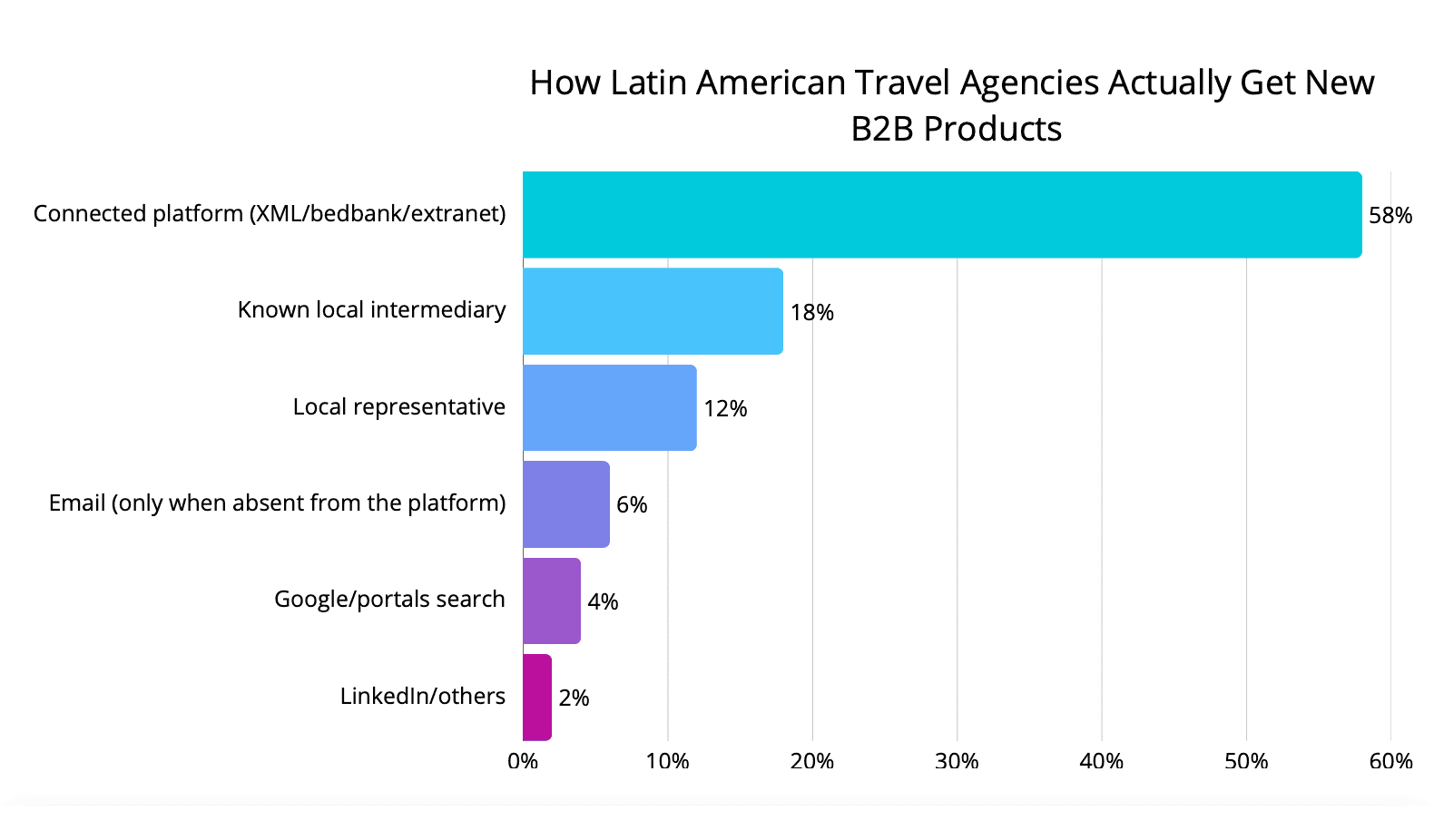

2) How Latin America Travel Agencies Actually Get New B2B Products

The connected platform is the most effective tool to operate: it concentrates inventory, rules, and immediate execution. Commercial conversion improves when there is a local relationship: a trusted contact and 1:1 visits reduce friction and accelerate real trials. As detailed in our article on travel trade shows, face-to-face events and agency visits are decisive to transform visibility into real distribution. Email ties up loose ends; open searches and networks add signal but rarely open business.

📌 Examples of wholesalers/bedbanks (XML/extranet) currently active in LATAM:

- Hotelbeds → one of the most widely used global bedbanks among agencies in Latin America.

- Expedia TAAP → Expedia’s program connecting agencies with hotel, air, and ground inventory.

- WebBeds → international group with brands such as Sunhotels, FIT Ruums, and JacTravel, active in the region.

- Bedsonline → B2B platform for travel agencies, part of the Hotelbeds group, with wide hotel and ground coverage, heavily used in LATAM.

- TBO Holidays → global consolidator with a growing presence in Latin America.

- HotelDO → Mexican-born B2B wholesaler with extranet and XML connectivity, widely used by agencies in Mexico and across Latin America.

- Connected platform (XML/bedbank/extranet): 58% — unifies inventory and rules; immediate execution.

- Known local intermediary: 18% — solves out-of-catalog cases; provides certainty.

- Local representative / face-to-face visit: 12% — trust, post-sale, response speed.

- Email (only when absent from the platform): 6% — closes loose ends; does not discover or prioritize.

- Google/portals search: 4% — last resort, diffuse.

- LinkedIn/others: 2% — contact channel, rarely a business driver.

Reading: Being connected to an XML or extranet platform means the product is technically there—but within an ecosystem hosting thousands of similar listings, it’s often invisible. Agencies rarely explore new options unless someone brings the product to them. That’s why local intermediaries (18%) and representatives (12%) play such a decisive role: they translate visibility into action, validate conditions, and build the trust required for a first booking.

In Latin America, success depends not only on being connected but on having a local team that promotes, explains, and supports the product until it becomes part of the agency’s daily workflow.

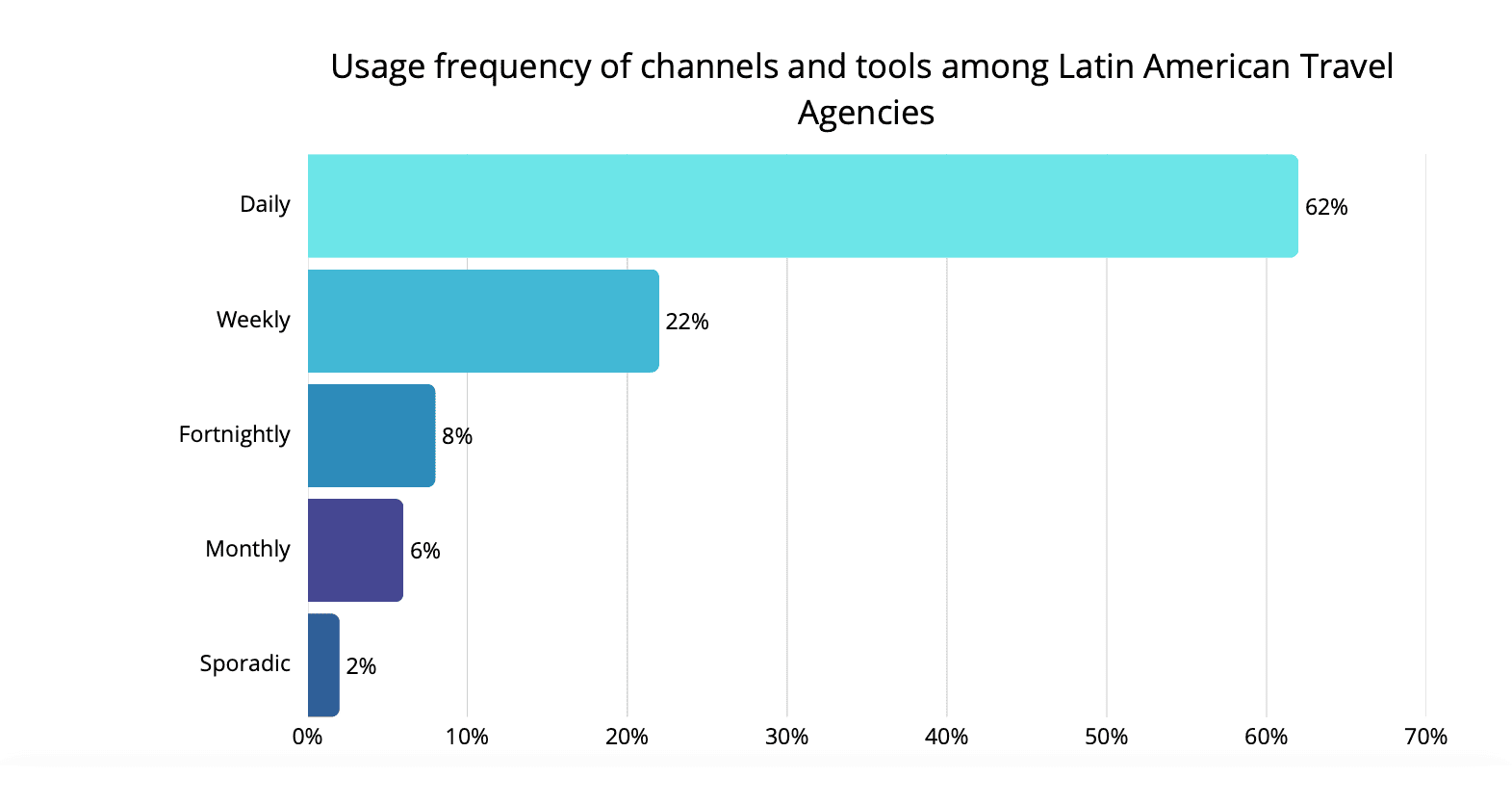

3) Usage frequency of channels and tools among Latin America Travel Agencies

The channel’s daily pulse is transactional: the connected platform is used every day and complemented with weekly adjustments. Promotion/relationship actions are scheduled on fortnightly or monthly cycles; the rest is sporadic.

- Daily: 62% — (primarily connected platform)

- Weekly: 22% — (operational adjustments, point queries)

- Fortnightly: 8%

- Monthly: 6% — (visits/one-off promotion)

- Sporadic: 2%

Reading: The operational rhythm of agencies is daily and transactional: 62% of bookings are made directly through the connected platform. This means that if a provider does not actively promote the product and train agents on how to book it, agencies will keep selling what they already know.

Agents do not research or look for new products on their own; for a new product to generate sales, it must be visible on the platform and supported with consistent promotion and training.

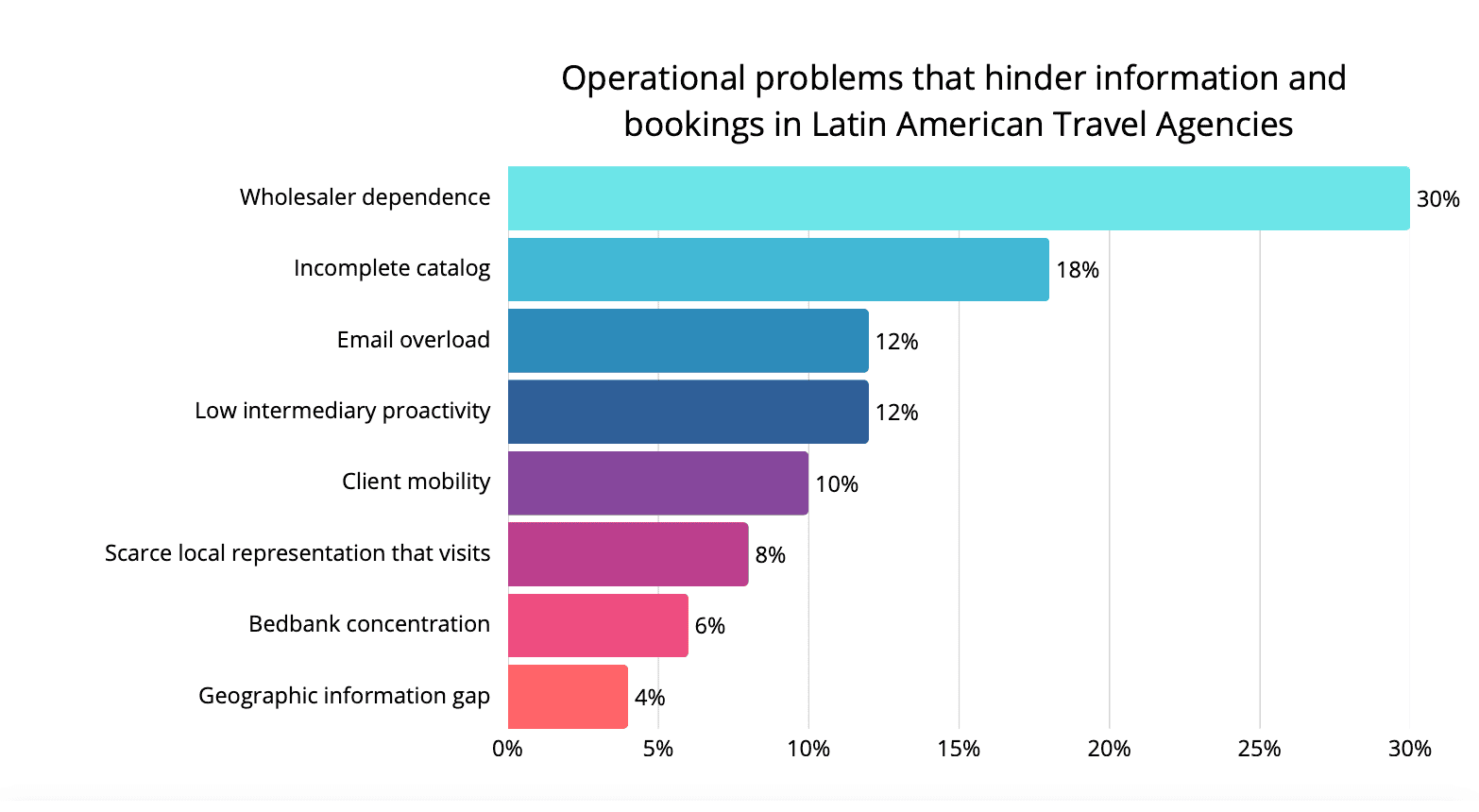

4) Operational problems that hinder information and bookings in Latin America Travel Agencies

Frictions are primarily operational: wholesaler dependence without a usable direct channel, incomplete catalogs in B2B/API, and email overload without centralization. Added to this are lower proactivity from some intermediaries, limited local presence, and inventory concentration.

- Wholesaler dependence / no usable direct channel: 30%

- Incomplete catalog/API (stock, net rates, policies, blackouts): 18%

- Email overload (if not centralized, it is not read): 12%

- Low intermediary proactivity (limited to “taking” bookings): 12%

- Client mobility/logistics without a car (transfers/routing): 10%

- Scarce local representation that visits: 8%

- Bedbank concentration (less visibility of novelties): 6%

- Geographic information gap (info does not reach certain markets): 4%

Reading: The challenge is operational rather than promotional. Agencies in Latin America need B2B providers that complement marketing visibility with local business development teams, a regional call center in their language, and sales support that ensures continuity after the first booking. When operational questions or mapping issues arise, the absence of nearby support slows activation and confidence drops.

Providers that maintain representation and local assistance — on-site, by phone, and through structured follow-up — achieve faster product activation, better communication, and long-term agency engagement.

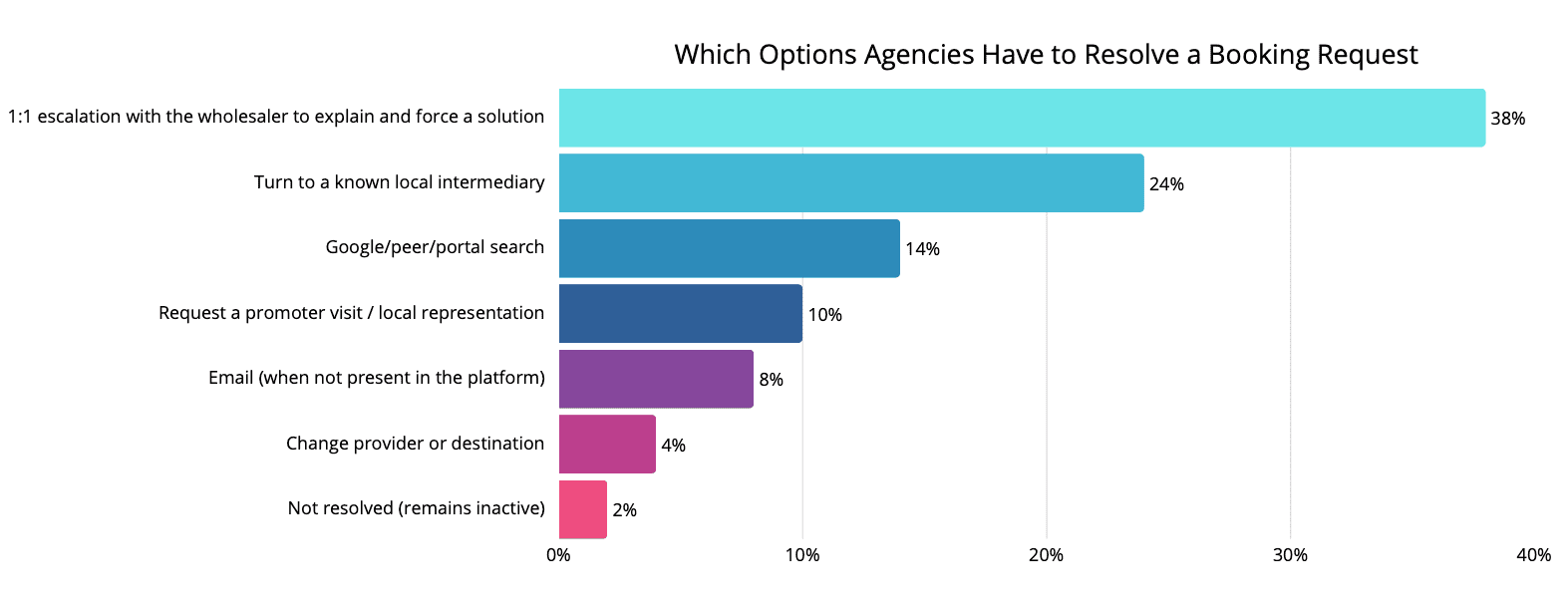

5) Which Options Agencies Have to Resolve a Booking Request

When a blockage occurs, agencies escalate through known paths: 1:1 management with the wholesaler and, when applicable, with trusted local providers/representations. If progress stalls, they turn to search and peers, or request local visit/support. Changing provider/destination is a last resort.

- 1:1 escalation with the wholesaler to explain and force a solution: 38%

- Turn to a known local intermediary: 24%

- Google/peer/portal search: 14%

- Request a promoter visit / local representation: 10%

- Email (when not present in the platform): 8%

- Change provider or destination: 4%

- Not resolved (remains inactive): 2%

Reading:

The issue is not the agencies’ lack of interest, but the absence of a clear operational interlocutor. When there is no local figure with defined response times (SLA), agencies turn to whoever replies first and end up prioritizing the products they already know.

The solution lies in establishing local commercial representation to handle issues directly with agencies and wholesalers, a regional call center that provides real-time assistance in the market’s language, and a structured sales support system with consistent follow-up and traceable communication.

This model ensures operational continuity, sustained product activation, and a better experience for the agency, preventing new contracts from remaining inactive or shifting to other suppliers.

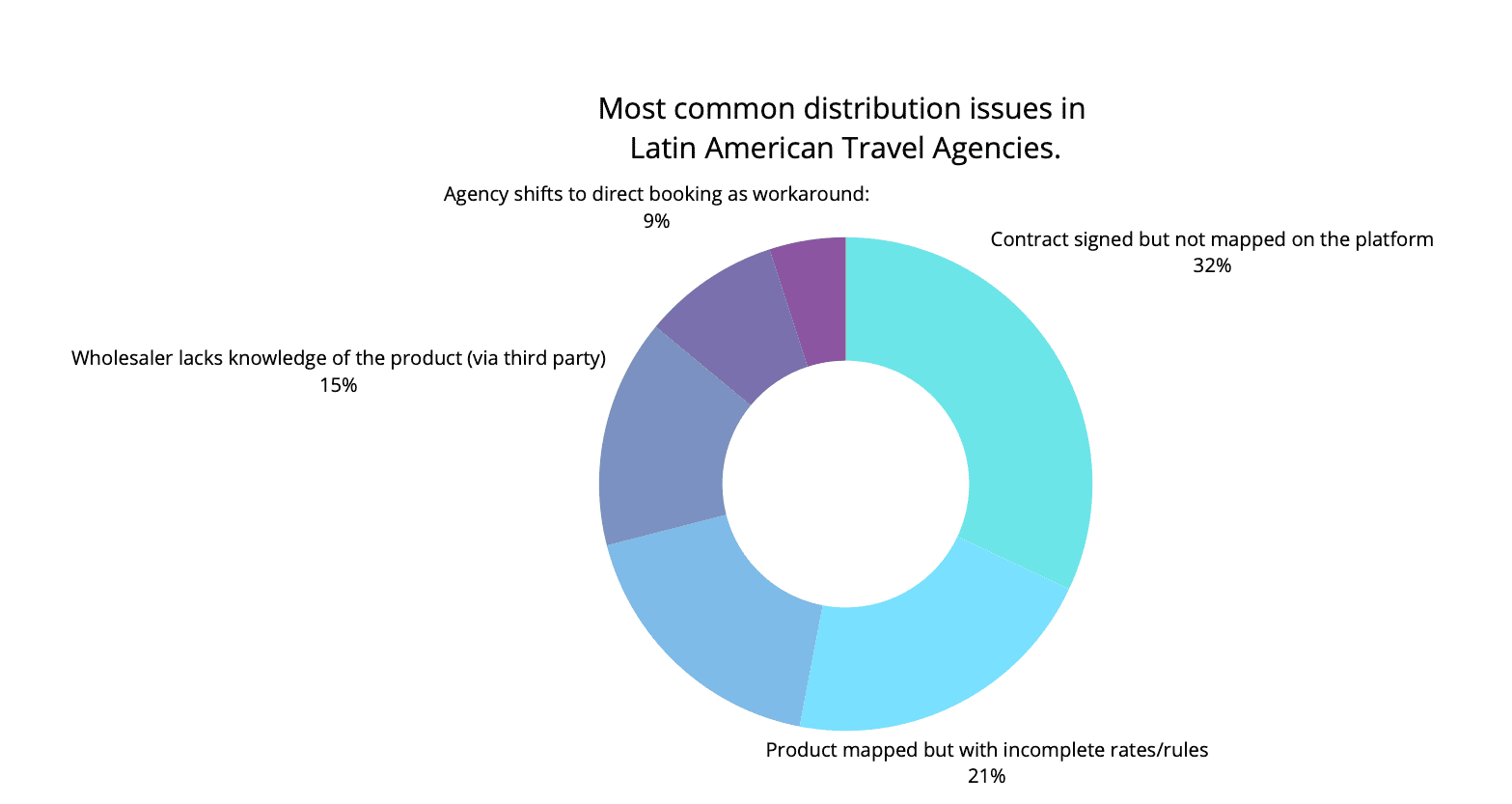

6) Most common distribution issues in Latin America Travel Agencies.

When reviewing how agencies interact with new suppliers, a critical point emerges: the gap between signed contracts and real visibility on booking systems. Many providers believe that once a contract is in place, the product is automatically available to sell — but in Latin America, this is rarely the case.

Agencies frequently face technical and procedural bottlenecks that prevent them from finding, quoting, or booking the product in their connected platforms. Mapping errors, incomplete rate rules, and lack of follow-up from intermediaries result in contracts that exist on paper but never reach the market.

This module identifies the most recurrent operational breakdowns that cause products to remain invisible or unbookable, despite being officially loaded and signed.

Reading: The data shows that the main obstacle is not signing contracts, but ensuring their real activation inside booking systems. More than one-third of products never appear on the agencies’ platforms, and another 21% remain blocked due to incomplete conditions. In practice, this means that nearly half of signed agreements fail to turn into sales.

To prevent this, a three-layer support structure is required:

A dedicated product technical team, continuously monitoring mapping in bedbanks and validating rates, rules, and policies to guarantee that every signed contract is both visible and bookable.

Local commercial representation, ensuring during agency visits that the promoted product is actually active and accessible in the system.

Centralized operational support, through a regional call center in the market’s language, handling incidents, accelerating responses, and ensuring continuity.

With this structure in place, contracts move beyond formal agreements to become active, bookable, and recurring inventory, enabling agencies to find, reserve, and confidently integrate them into their sales flow.

Operational Conclusion 2026 — Latin America Travel Agencies

Central thesis (necessary and joint):

To succeed with Latin American Travel Agencies in 2026, four simultaneous conditions are required — not interchangeable or sequential:

Connected platform readiness: every product must be mapped, visible, and bookable in the wholesaler/bedbank (XML/extranet) with complete rates, allotments, and rules.

Dedicated product technical team: continuous monitoring of mapping, validations, and updates to prevent contracts from remaining invisible or blocked by incomplete conditions.

Local commercial representation: in-person promotion and validation during agency visits, ensuring that what is being offered is actually operational in the booking system.

Centralized operational support: a regional call center in the market’s language and structured sales support with defined SLAs, providing real-time responses and ensuring continuity.

Without this four-part structure, contracts risk remaining inactive, confidence erodes, and sales cannot scale. With it, however, agencies gain visibility, trust, and operational continuity — the three factors that consistently turn contracts into activated, recurring business in Latin America.

Why (evidence from the updated data)

Platform = daily engine

Agencies rely on connected platforms every day (74%) and the platform is their main tool (58%) because it centralizes inventory, rules, and execution.

Critical technical gaps

Yet, 32% of contracts never appear in the agency’s booking system. Being uploaded into a bedbank does not guarantee proper mapping or visibility. Another 21% show up with incomplete rules, which makes them unbookable.

A needle in a haystack

Uploading a product into a LATAM distribution platform is like dropping a needle in a haystack. The product competes with thousands of others. Agencies rarely browse platforms to “discover” new products — they use them to book directly. They filter by price and category, and if the product doesn’t make it to the first page, it is often never seen at all.

Value of one-to-one visits

Face-to-face visits are the only way to confirm that the product is actually available in the booking flow and that rates are competitive. These visits also provide product training, helping agents understand the offer and feel confident selling it.

Local relationship as adoption driver

A trusted intermediary (18%) and direct visits (12% as effective tool; 6% as entry channel) are the factors that turn a passive listing into an active commercial offer.

Friction is mostly operational

Main barriers are operational, not promotional: delays from XML distributors (18%), wholesalers lacking product knowledge (15%), and email overload (12%).

Observed outcome

Without local support, only 3–5% of contracts lead to a first booking. With proper Local Support — Business Development, Marketing actions, Call Center, and Sales Support — conversion rises to 15–20% for first bookings and 10–12% for repeat sales.

Minimum viable actions (directly derived from the findings)

1. Products on connected platforms (XML/bedbanks)

Products must be mapped and visible in the B2B/API, with net rates, parity, policies/fees, and blackout dates uploaded directly into the system.

But uploading a contract is not enough: in a mass distribution platform, the product is like a needle in a haystack. Agencies filter by price and category and book what they already know; new products often remain unnoticed.

That is why local representation is vital: visiting agencies, checking if the product is actually displayed, reviewing competitiveness of rates, presenting the offer, and explaining how it works. Only then does an XML contract become an active, sellable offer.

2. Products requiring direct management (groups, MICE, luxury, circuits, destinations, transport, tailor-made experiences)

Activation of these products depends on local presence, one-to-one visits, product training, and fast turnaround on requests.

These segments expect personal interaction and customized solutions; a catalog or listing alone does not guarantee adoption without a local contact to promote and support it.

3. Local commercial presence to drive adoption

Face-to-face visits turn a product (platform listing or PDF) into an active commercial offer: rates are validated, competitiveness is checked, and agents are trained.

That’s why trusted intermediaries (18%) and in-person visits (12%) make the difference and offset scarce local presence (8%).

4. Local operational support with SLAs and a single point of contact

There must be a clear owner (phone/WhatsApp and centralized email) with defined SLAs for both commercial and operational issues.

In practice, agencies sell what gets a fast and reliable response (today they escalate to the wholesaler 38% or to local representation 24%).

Risk Assessment for Implementation Gaps

The four components are interdependent. Missing any of them undermines activation and commercial scale.

1. Without a local Business Development team

Impact: even if the product is uploaded and mapped, it gets lost among thousands of options. Agencies book what they already know; new products remain invisible.

Evidence: agencies that do not receive direct visits or product presentations rarely test new products (3–5% conversion without support).

Effect: contracts on paper that never turn into real sales or sustained adoption.

2. Without direct management for offline products (groups, MICE, luxury, destinations, transport, tailor-made experiences)

Impact: these products cannot activate through platforms; they require customized proposals, negotiation, and local follow-up.

Evidence: agencies in these segments bypass providers lacking local teams to handle complex requests.

Effect: low adoption in high-value categories and lost opportunities outside XML.

3. Without local commercial promotion

Impact: whether online or offline, contracts remain passive; agents default to what they already know.

Evidence: absence of visits and representation keeps conversion minimal (3–5%).

Effect: limited testing and weak initial adoption.

4. Without local operational support (SLA and single point of contact)

Impact: incidents stall; agencies shift to whoever answers first.

Evidence: 18% delayed XML responses, 9% direct bookings with providers, 5% provider/destination changes.

Effect: active contracts lose continuity, recurrence drops, and attrition rises.

How to measure whether the triad works

Adoption conversion: track the flow Signed Contract → First Booking → Repeat Sales.

Local activation effectiveness: validate during visits that products are visible on the platform (when applicable) and that offline products (groups, MICE, luxury, transport, circuits) are being quoted and booked.

Response timeliness: measure TTR (Time to Response) against defined SLAs for both commercial and operational issues.

Resolution quality: share of incidents resolved on time and logged through traceable channels (tickets, calls, centralized email).

Channel behavior: proportion of sales initiated and executed on-platform vs. those managed directly/offline, ensuring both paths sustain continuity.

In one sentence

For Latin American Travel Agencies to activate and sustain sales in 2026, uploading contracts to a platform is not enough. A four-layer structure is required:

- Products properly mapped and visible in connected channels,

- A local business development team visiting agencies and checking competitiveness,

- Commercial representation actively promoting both online and offline products (groups, MICE, luxury, transport, experiences),

- And centralized operational support with SLAs and a single point of contact.

Only with this combination do contracts move from passive listings to active, recurring, and sustainable offers.

How to Overcome These Challenges with B2B Travel Partner

Why leading B2B providers trust B2B Travel Partner to activate sales in Latin America

Success in Latin America requires much more than uploading contracts to a platform crowded with thousands of providers. To truly stand out, international suppliers need local teams who understand the market, communicate the product clearly to agencies, and provide operational support in their language with defined SLAs. By working with B2B Travel Partner, your brand gains visibility in the right platforms, trusted promotion in local markets, and immediate problem-solving capacity, ensuring that contracts turn into real bookings and sustainable growth across the region.

The study results are clear: in 2026, having contracts mapped is not enough. Uploading a contract to a platform with thousands of providers turns it into a needle in a haystack. To transform contracts into real sales, beyond correct mapping, it is essential to:

Communicate and train agencies: provide clear information, sales materials, and training so that they know the product, understand how to sell it, and include it in their portfolio (this applies to both online and offline products such as groups, MICE, DMCs, luxury, tailor-made circuits, transportation, etc.).

Have a nearby local team: agencies only trust and prioritize a product when they know there is a team in their market who understands their needs, knows the local business culture, and can explain benefits, resolve doubts, and support the sales process. This local presence is what differentiates your product among thousands of options.

Provide operational support with SLA: without quick response and direct contact in their language, agencies drop the product and return to known providers. A local support team guarantees continuity, trust, and effective incident resolution.

Let’s Unlock Your Global Potential Today

Don’t wait to connect with the right partners and markets. Our team is ready to help you grow your tourism business in key markets like LATAM and Europe.

- Gain access to top travel operators, agencies, and wholesalers.

- Boost your international visibility with proven strategies.

- Achieve measurable results that impact your bottom line.